Under Indian tax law, Section 80G grants tax advantages to individuals who make charitable contributions to eligible organizations. These contributions are deducted from your taxable income, effectively reducing the amount of taxes payable. The extent of the deduction depends on the type of organization and the nature of the gift. It's crucial to note that Guide only donations made to recognized charities are eligible for this deductible clause

To avail of the tax benefits under Section 80G, it is essential to obtain a receipt from the recipient organization. This proof should clearly state the amount donated and the organization's registration number. It's also advisable to consult with a tax professional for personalized guidance on maximizing your charitable deductions under Section 80G.

Recording Charitable Donations: A Journal Entry Guide

Making a gift to a charitable organization is a generous act. But for nonprofits and individuals who receive these contributions, proper tracking is essential. A journal entry is the foundation of this process, ensuring accurate representation of every charitable exchange. We'll walk through a simple example to illustrate how to create a journal entry for a charitable donation.

- When a contributor makes a cash contribution, the organization will record an asset account called "Cash" to reflect the growth in its cash balance.

- Concurrently, a credit entry is made to a liability account called "Contributions Receivable." This accounts the obligation of the organization to use the donated funds for their intended goal.

This basic journal entry provides a clear and concise snapshot of the charitable donation. It is crucial for maintaining accurate financial records and ensuring openness in philanthropic operations.

Maximizing Your Impact: Donation Receipts and Tax Deductions

giving to charitable causes can bring immense joy. However, it's also important to understand the tax implications of your generosity. Obtaining legitimate donation receipts is crucial for claiming potential breaks.

A receipt should clearly state the name of the recipient organization, the amount donated, and the date of the contribution. Keep these receipts in a secure manner for your records. During tax season, consult with a tax professional to enhance your tax-deductible donations and minimize your obligation.

By understanding the process of donation receipts and tax deductions, you can guarantee that your contributions have the greatest impact on the causes you support in.

Comprehending the Power of Giving: A Guide to Charitable Donations

Giving back to your community is a profoundly rewarding experience. Gifts to non-profits have the power to transform lives.

By supporting initiatives that align with your values, you can influence the world around you. Whether it's delivering essential services, advancing education, or lifting communities, your generosity can inspire others.

Here are some guidelines to help you navigate the world of charitable giving:

- Explore various charities thoroughly

- Identify causes that resonate with you

- Choose wisely where to allocate your funds

Creating a Difference: The Importance of Donation Receipts

Donations drive vital charities and support countless individuals in need. Every contribution, minute, makes a tangible impact, improving lives. Yet, amidst the kindness of giving, it's crucial to remember the importance of donation receipts. These simple documents serve as a vital tool for both donors and charities.

For donors, receipts provide tangible proof of their generosity, which can be invaluable for taxdeductions purposes. They offer comfort knowing their contribution is acknowledged officially. Moreover, receipts allow donors to record their giving history, facilitating informed generous decisions in the future.

Charities, on the other hand, rely on donation receipts for transparency. Receipts prove to donors and regulatory bodies that funds are being managed responsibly. They build trust and confidence, which is crucial for attracting continued support.

Ultimately, donation receipts are a small but impactful gesture that strengthens the entire charitable giving process. By equipping both donors and charities with clarity and transparency, receipts help promote a culture of trust and lasting impact.

The impact of charitable giving

Charitable giving extends significantly past mere financial support. A donation, no matter the size, can spark a chain reaction of positive outcomes that spreads throughout communities and beyond.

It's about empowering individuals to thrive, nurturing a sense of togetherness, and promoting social advancement.

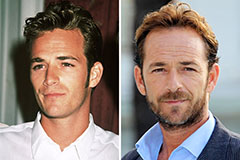

Luke Perry Then & Now!

Luke Perry Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!